Words can hardly describe what is currently happening in Argentina. The man with the chainsaw has actually won the presidential elections by a landslide. Javier Milei, the self-proclaimed anarcho-capitalist, has chased the ruling Peronists out of office and, if he even halfway fulfils his “election promises”, will cause enormous damage to the country over the next four years (as already described here in August after the primaries).

It is yet another failure of the left, although any Argentinian citizen could have known that conservatives or even libertarian anarchists would cause even greater harm than the left. In December 2015, Mauricio Macri became president under very similar circumstances. The conservative had promised to finally free the country from the clutches of the quasi-socialists led by Peronist Christina Kirchner and lead it into a bright new future.

One of Macri’s first acts was to reach an agreement with the so-called vulture funds, which had never agreed to Argentina’s debt haircut on dollar bonds. Also, under Macri, Argentina agreed with the IMF (which many years before was considered the direct representative of the devil in Latin America) on a huge “aid program”, which of course came with conditions attached, but which played into the hands of Macri’s economic program of austerity and monetary “soundness” (as shown here).

The result was the worst economic development imaginable: The country was unable to find a way out of an extremely deep recession, the inflation rate had risen to almost 50 per cent (with huge consequences for the population’s purchasing power) and short-term interest rates were at 60 per cent, while the exchange rate of the peso against the US dollar plummeted. In the elections in October 2019, Mauricio Macri was then replaced as president by Alberto Fernández (the former head of Christina Kirchner’s cabinet), which meant that the Peronists had another four years of opportunity to make fundamental changes.

But they also squandered this opportunity recklessly. Today, inflation is over 140 per cent, the economic malaise has not been overcome and the government’s social “good deeds” are always just a drop in the ocean that ultimately fails to impress even the poorest.

The two major Latin American countries, Argentina and Brazil, suffer above all from an enormous economic theory deficit. It was easy to predict that the conservative-liberal therapies that both Macri and his conservative colleague Bolsonaro want to try out in Brazil will never work. But Latin America’s misery goes deeper than this and cannot be overcome simply by choosing between left and right.

False theories in both political camps

The central problem in Latin America is that it is almost never possible to combine monetary stability with favourable investment conditions. Since the monetarist doctrine of the importance of money for inflation is firmly believed throughout, the mantra of all central banks is that inflation can only be kept in check with a strict, i.e. restrictive, monetary policy. If there is constant inflationary pressure, the relationship between interest rates and earnings expectations, which is crucial for companies’ investment activity, becomes clearly positive in such a constellation, which means that interest rates are almost always too high.

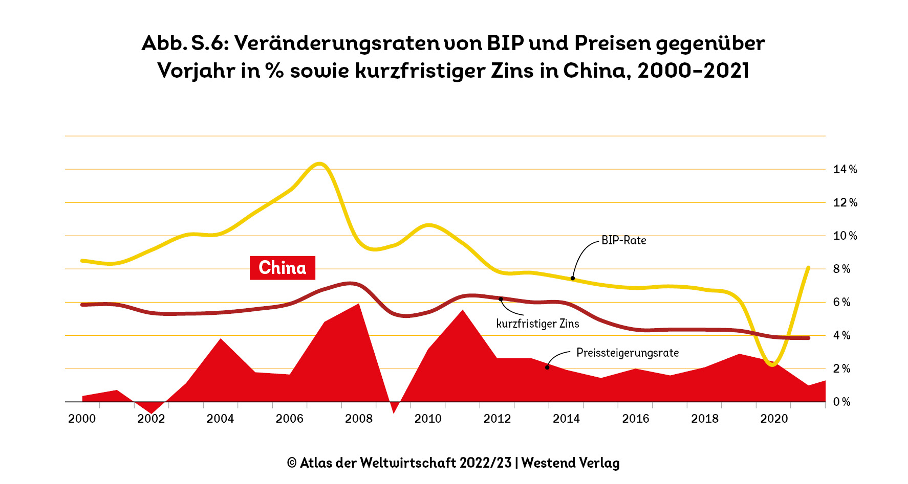

China has shown how to do it right. As the graph below from the Atlas of the World Economy shows, the nominal short-term interest rate (the red line) here is practically always even lower than real GDP growth (yellow line). This has been achieved in China because inflation (red shaded area) has been controlled by reaching a consensus, with the active assistance of the government, on wage increases that are compatible with monetary stability. Because inflation is always a wage and not a monetary phenomenon in the long term (as shown here), it was possible to pursue a monetary policy that massively promoted investment activity at the same time.

It should be noted that such a concept is not based on lower but on higher real wage growth. In Brazil and Argentina in particular, as in most developing countries – with the exception of a small group of successful countries in Asia – the mass of workers are not, and above all not systematically, involved in productivity progress. Although there were and are many indexation mechanisms that ensure that wages are linked to inflation in one way or another, there is no systematic participation in productivity progress.

But only the constant increase in real wages in line with the pace of productivity and low interest rates are a guarantee of economic success. However, in the course of the neoliberal revolution, precisely this was declared the devil’s bargain and increasingly dismantled in the northern countries as well. The emerging and developing countries (outside Asia) were forced to believe that the exact opposite, namely “flexibilisation” and “structural reforms”, were the only way to happiness.

Only the systematic application of an inappropriate theory can explain why the whole of Latin America remains at a level of development that the Asian developing countries have long since left behind. In the forty years in which Latin America has struggled with ever new variants of a nonsensical theory, China has largely abandoned the status of a developing country – despite a far less favourable starting position. It is no coincidence that Latin America has made no real progress since the end of the Bretton Woods global monetary system. The interplay of neoclassical-neoliberal recipes combined with complete freedom for trade and capital movements could never work.

If a radical libertarian who only relies on markets now takes power in Argentina, things can only get much worse. But we must never forget that such a person could only come to power because the seemingly progressive governments failed to take advantage of the many opportunities they had. To be successful in the long term, it is not enough to take a few measures that benefit the poorest. What is needed is a better macroeconomic theory on the basis of which a new, consistent approach to economic policy can be developed.