Cross-posted from Makroskop.eu

Translated and edited by BRAVE NEW EUROPE

There is still speculation about the depth of the corona crisis. The crucial questions are undoubtedly how long the economy will have to remain largely stagnant in order to fight the pandemic and how quickly demand will recover afterwards. At present, one can only speculate about the first question or assume various scenarios. The answer to the second depends to a large extent on the way in which the state tackles the cushioning of the economic consequences.

For the time being, however, the impact of the slump seems to be completely underestimated. Most observers still believe that the current downturn will be of a magnitude comparable to the financial crisis of 2008/2009. This is certainly wrong.

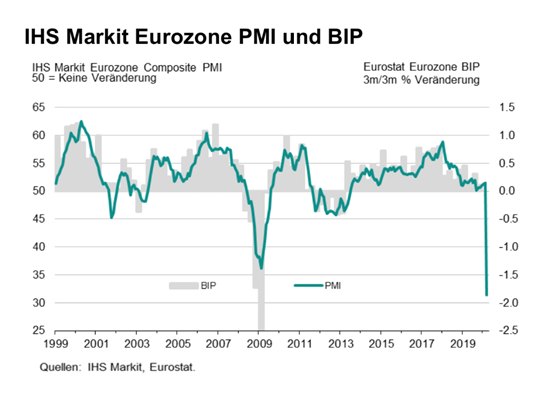

The PMI (Purchasing Managers‘ Index) published by IHS Markit for the euro zone on 24th March, which is based on surveys of companies (here the PMI composite, which looks at various sectors together), gives an impression of the current force of the downturn compared with the recession at the time. As Markit’s original chart shows (see Figure 1), the index fell from just over 50 points to just over 30 points in March (the index is constructed so that 50 points marks the dividing line between growth and recession). This can be directly compared with the crisis of 2008/2009.

It is already clear at first glance that both “downturns” differ considerably in their dynamics. In 2008/2009 there was also a rapid downward movement, but the month-to-month movements were very small compared with the current development: a decline of 20 points in a single month has never been observed before.

Figure 1

IHS Markit Eurozone PMI and GDP (BIP)

Moreover, the month of March considered here was not even completely affected by the shutdown. The effects of the uncertainty of many consumers and companies due to falling revenues have not yet been fully felt here. The less deep fall of the index in the previous crisis, which after all lasted for more than a year, was associated with a fall in GDP in the euro zone of 4.5 percent in 2009.

The ifo index published on 25th March shows a similarly dramatic trend for Germany (Figure 2). This index, too, has never seen such a rapid decline before.

Figure 2

ifo Business Climate Index for Germany

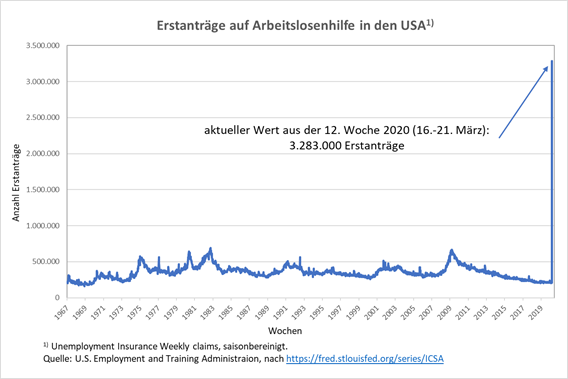

Even more dramatically, the current number of initial applications for unemployment assistance in the US is by far the highest since this statistic began in 1967, jumping from 280,000 two weeks ago to 3.3 million last week (Figure 3). In Europe, the situation in the labour market is likely to be similarly dramatic (whether it is open unemployment or short-time work), but no up-to-date statistics are available here as yet.

Figure 3

First applications for unemployment benefit in the USA

In many areas, the corona crisis meant a total loss of production, whereas previous crises have only involved a decline in production in individual, particularly vulnerable areas in the order of a maximum of ten percent compared with the previous year. Now we are talking about an absolute standstill, even for many service providers who have never been affected in this way before. In the manufacturing sector, many production facilities, including very large ones such as automotive plants, have been completely shut down, whereas in previous recessions capacity utilisation has dropped by ten to fifteen percent.

If major institutional distortions occur in EMU because not all countries are given the same financial opportunities to support their economies, trade and German exports are unlikely to normalise for a very long time. Many articles published in Germany have already indicated that some Northern countries are not willing to allow Italy to cushion its companies and employees in the same way and on the same scale as Germany.

If we add to this the fact that in Europe’s largest trading partner, the USA, the crisis has a certain lag compared to Europe, trade relations with the USA cannot be expected to return to normal before the summer, even on the optimistic assumption that measures to contol the virus will be successful and rapid. The development in unemployment figures already demonstrates this very clearly. This in turn is particularly dramatic for Germany, since the United States is the largest surplus trading partner, i.e. the country with which Germany has achieved the largest trade surplus in recent years.

Understanding crisis management

The medical safety measures to combat the coronavirus are thus accompanied by a tremendous economic crash in Germany, Europe and worldwide. And already voices are being heard warning that the shutdown will do more harm than good. In view of the developments on the labour markets, it cannot be ruled out that this controversy will not only be conducted louder, but may even lead to a panic reaction by the government in the USA, which could end in a premature lifting of the shutdown there.

This seems to lead to the conclusion that we have to choose between how many corona deaths we have on the one hand and how many unemployed and destroyed economic livelihoods we have on the other. But this choice does not present itself when we look at the economic context objectively.

The state has to ensure both that no one has to suffer in the short term, and also that the shutdown does not turn into a lasting depression in the medium to long term. The best way to achieve this is for the state to make transfer payments so that no citizen suffers a loss of income from work compared with his or her previous situation during a three-month shutdown, for example. In concrete terms, the incomes of those demonstrably affected by the shutdown must be increased to up to a quarter of their annual income in 2019 – in line with the duration of the shutdown.

Of course, the part of the generous transfer payments that is not spent would end up in the recipients’ savings coffers, but that does not hurt. The money would later flow back into the economic cycle. There is also nothing to be said against showing all those who benefit from such a generous transfer scheme ways in which they can help out temporarily – a major mediation task for job centres, for example.

Where does the money come from?

Although the German government has already taken steps to support falling incomes, and even though the debt brake has just been lifted and the figures in the supplementary budget with 156 billion euros of new government debt sound gigantic, it is too little to convince the population of the correctness and duration of the measures to combat the pandemic in such a way that they do not adjust their behaviour downwards and thus cement the economic crisis.

Above all, ruling politicians are afraid to explain that the financing of the measures will need additional national debt. This is difficult for them because for years they have presented a “black zero“ in the national budget – ie neither a deficit nor a surplus – as an economically sensible target that is urgently needed for the functioning of the economy as a whole. Anyone who says that Germany can afford the new debt that has now been decided on, thanks to its solid public finances, is inevitably confronted with the questions: How much additional debt can the state can allow itself in the long term? When must it stop before it becomes unsound again and harms the private sector.

This is the heart of the problem. Politicians would have to explain that the money for the transfer payments does not have to be laboriously obtained from somewhere, that it does not last just a few weeks at most, that such a measure will not lead to inflation sooner or later, and that this money does not have to be paid back. This is exactly what needs to be explained if people are to have lasting confidence in an extremely large-scale transfer measure. But the objection is raised: How can one distribute money on a large scale without dramatic consequences in a world where little is produced? Surely a large mountain of money would then only be matched by a small mountain of goods? How is this to go well and not end up in inflation? And where should the money come from?

Money is the mutual promise of the members of a society based on the division of labour to produce goods every day in accordance with the medium of exchange provided by the central bank and the banks. Through work performance, the mountain of goods exchanged and consumed every day is replaced, so that the money paid among us is again matched by something real. Only by relying on this mechanism are people prepared to exchange a real good for a floppy note or a digital number in an account.

If the daily production process is now disrupted because of the pandemic, the money which, according to our proposal, will be made available at least in the amount of the previous level of mass income is actually temporarily offset by a smaller mountain of goods. This is not a problem in the short term, however, because the measures to combat the virus mean that no ‘excess demand’ can develop – from the moment that people no longer visit the furniture shop, car dealer, restaurant or travel agency. Those who receive more income transfers than they need for the most essential things fill their savings account.

So it is exactly the opposite of what microeconomic thinking would suggest: If we break down corporate structures, put people in fear of their livelihoods or even make them actually suffer hardship by making transfers that are too meagre and hesitant from the outset to help maintain the monetary processes of our economy, we will lack both production capacity and demand for the time after the pandemic. If we now generously finance the shutdown, which will not take years but only months, we can then return to the real structures that existed before the crisis.

The European dimension

Unfortunately, our leading economic policymakers show that they do not understand much about these interrelationships. There is a great danger that they will now set a permanent economic and political crisis in stone by resorting to the recipes and slogans that were already wrong in normal times (“Strengthen competitiveness in Europe”, said Economics Minister Peter Altmaier in the business daily Handelsblatt). In particular, they do not seem to be aware of the European dimension of the problem. The EU Commission President Ursula von der Leyen, who surely should take corrective action here, apparently has no idea what is really at stake and limits herself to general statements instead of aggressively addressing the essential need for unconditional monetary policy support.

After all, the operation of increasing money-supply via higher government deficits described above must be applied and orchestrated at the European level. Only if the ECB does the right thing and if all member states are given the same opportunity to cushion the severe economic slump can the aid operation also be successful for an individual country like Germany. After all, Germany had a trade surplus with Italy, France and Spain of 63 billion euros in 2019; the volume of trade between these three countries was 376 billion euros. If the economies of these three countries collapse severely for a long time, Germany will not be able to expect a recovery for a very long time, not to mention the political consequences.

The ECB has already made it clear in its initial announcements that it will ensure that interest rates on government bonds do not rise even if supply increases sharply (meaning that prices may fall, which would push up interest rates). To this end, the ECB will buy bonds on a large scale (initially there is talk of 750 billion euros). This is, of course, in its effect the famous monetary public financing, which was banned in the Maastricht Treaty. This is precisely why there is already considerable resistance to it in Germany – a fatal reaction which could very quickly lead to the complete collapse of EMU.

Typical of German resistance is the article by the former chief economist of the ECB, Otmar Issing, in the daily FAZ. Issing writes:

“With the announcement of a new program to buy bonds, the ECB is primarily trying to slow down the rise in interest rates of highly indebted countries. The ECB justifies this decision with its responsibility to defend the cohesion of the euro area and the existence of the euro and to safeguard the transmission mechanism of monetary policy. However, this argument does not alter the fact that, from an economic point of view, the main intention is to prevent the public financing of individual countries from collapsing. What is this other than monetary financing of public expenditure, which is forbidden by the Treaty?“

But that is exactly what it is all about! We want to save countries from the collapse of their public finances. What else can one want at the moment? Should countries like Italy, in addition to the medical catastrophe, also collapse economically because the state there – for whatever reason – is more heavily indebted than in Germany? The emergency does not justify breaking the law, Issing writes. Yes, it does. How is the legal claim to a dignified life in Italy to be weighted against the legal claim of a contract whose substance is dictated by Germany but was never reasonable? How will Germany’s European export markets develop if we do not concede to our partner countries that they, too, should be able to make a reasonable economic profit?

Throughout the world, particularly in the USA, China, Japan and the UK, it is absolutely natural that the central bank should take on the task of providing the states with the monetary ammunition they now need. Former ECB president Mario Draghi, too, says quite clearly and correctly in a statement that debt levels are rising either way, but that the costs of a proactive response by the states and the ECB are small compared with the loss of productive structures that can be expected if too little action is taken too late.

Will Europe fail on this issue? Martin Wolf writes in the Financial Times:

“This pandemic is not anybody’s fault. If the euro zone cannot show solidarity in such a crisis, its failure will be neither forgotten nor forgiven. The wounds will be deep, perhaps mortal. Without visible solidarity in a crisis for which nobody bears blame, the European project will be morally, maybe practically, dead.”

If politicians in Europe finally understood these interrelationships, there would be a great opportunity in this crisis to correct the fundamental mistakes that were made at the start of European Monetary Union. Unfortunately, this does not seem to be the case at present, especially in Germany.