The President of the Deutsche Bundesbank, Joachim Nagel, said in a speech in Frankfurt on 5 July 2023 that it was too early to sound the all-clear with regard to the price development in Germany, “Inflation has broadened overall.” And he adds: “According to our June projection, the inflation rate in Germany will remain high for the time being. The ECB’s June projection for the euro area gives a similar result.” This contrasts with the figures recently published by Eurostat on European price developments.

According to the EU’s statistics office, the rate of increase in consumer prices in two larger EMU countries has now fallen well below the 2 percent mark targeted by the European Central Bank (ECB): In Spain and Belgium the rate was 1.6 per cent in June. On the same day of the President’s speech, there was also the news that producer prices on the domestic market, which the ECB also considers a classic leading indicator to consumer prices, fell in absolute terms in May compared to April in all EMU countries except Malta and Cyprus. Compared to the previous year, producer prices in the EMU average have now also fallen below the level of the previous year (May 2022) for the first time since the price boosts starting in 2021. This does not yet apply to industrial producer prices excluding the energy sector, which are still 3.4 percent higher than a year earlier. But this sub-index has also been on the retreat for two months: growth rates compared to the previous month are already negative at -0.2 and -0.4 per cent. How anyone can be convinced that inflation has become broader remains a mystery.

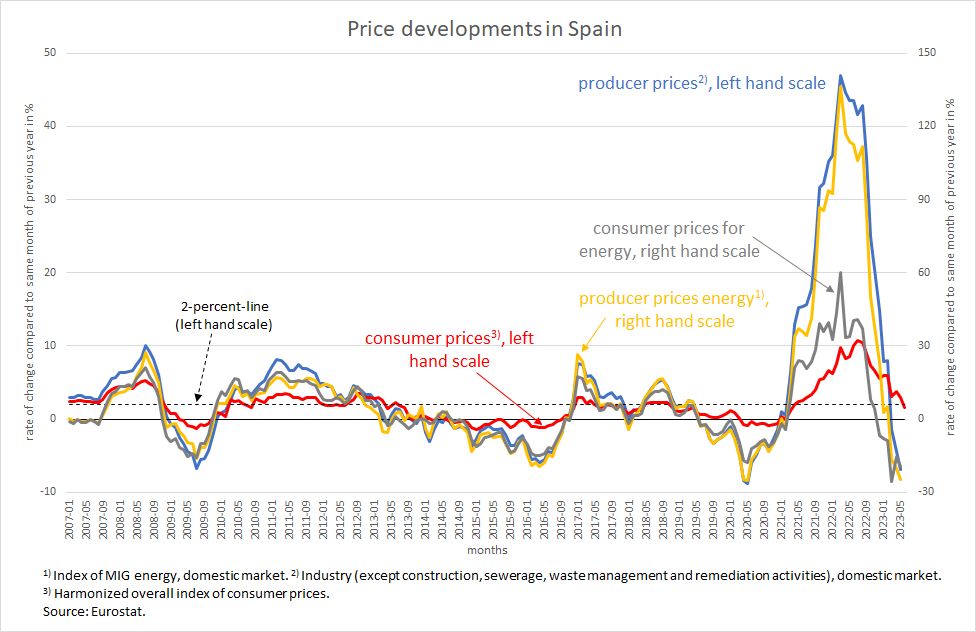

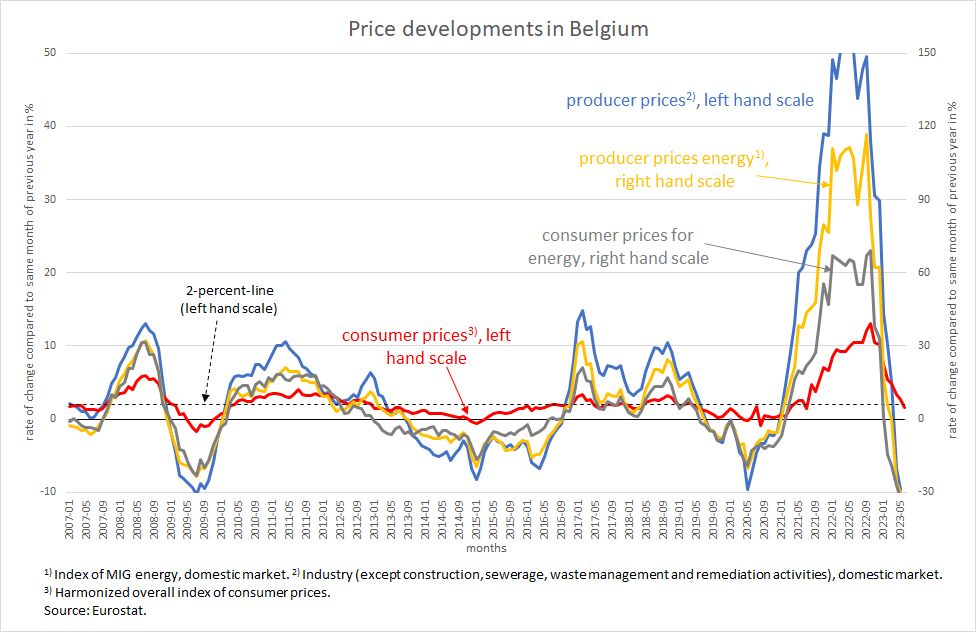

Spain and Belgium have taken the lead in terms of calming consumer price developments because energy prices have retreated the most there. This can be seen from the sub-indices for energy at both the producer and consumer levels compared to the overall indices.

In Spain (Figure 1), where inflation is now officially over, producer prices for energy are 25 per cent lower than last year (yellow line). Consumer prices for energy (grey line) are about 20 per cent below last year’s value. In Belgium (Figure 2), the decline in energy prices is even more pronounced: at the producer level it is now -30 percent, and at the consumer level -33 percent.

Figure 1

Figure 2

As a result, total producer prices (blue line) in both countries are also below last year’s levels, now by around 7 percent in Spain and 10 percent in Belgium. This has put downward pressure on the development of consumer prices (red line) to such an extent that there can no longer be any talk of inflation.

In both countries the so-called core rate, i.e. the increase in the consumer price index excluding energy and food, is still well above the desired 2 per cent in May (Spain 3.8 and Belgium 6.8; not shown here). But this is probably mainly due to the fact that even in this core rate almost all goods and services included are produced using energy, but the adjustment of their prices to the increased energy price level has not yet been completed. Possibly, by delaying the passing on of their increased energy costs in the prices of their end products, the companies in the corresponding sectors are only gradually approaching their customers’ willingness to pay in order not to lose them (completely). This is because the companies know that their customers’ incomes are already heavily burdened by the increase in the price of energy as an end product (heating, filling up the tank, etc.) and in this respect the competition for demand in the markets for things that are not directly necessary for life is currently fierce. On the other hand, companies cannot sustain cost-related profit losses over long periods of time. Therefore, the delayed and now still persistent price increase within the core rate is quite explainable.

That relatively high food price increases will persist in the face of climate change is likely. But if prices correctly indicate changes in relative scarcities and do not increase non-specifically due to wage-price-spirals, they precisely play the role they have in a market economy: They encourage investors to innovative capital formation to reduce bottlenecks. Unfortunately, making innovative solutions more difficult by raising interest rates is exactly the wrong thing to do in such a situation.

It is noteworthy that such a constellation – albeit on a considerably smaller scale – has also been observed between the dynamics of energy prices and those of the overall price bundle after the global financial crisis of 2008/2009. In both countries, consumer prices as a whole followed the movement of energy prices – both upwards and downwards and even below the zero line. This prompted the ECB to start its zero interest rate policy about ten years ago. This time the overall price movements are much larger, but that does not change the underlying logic.

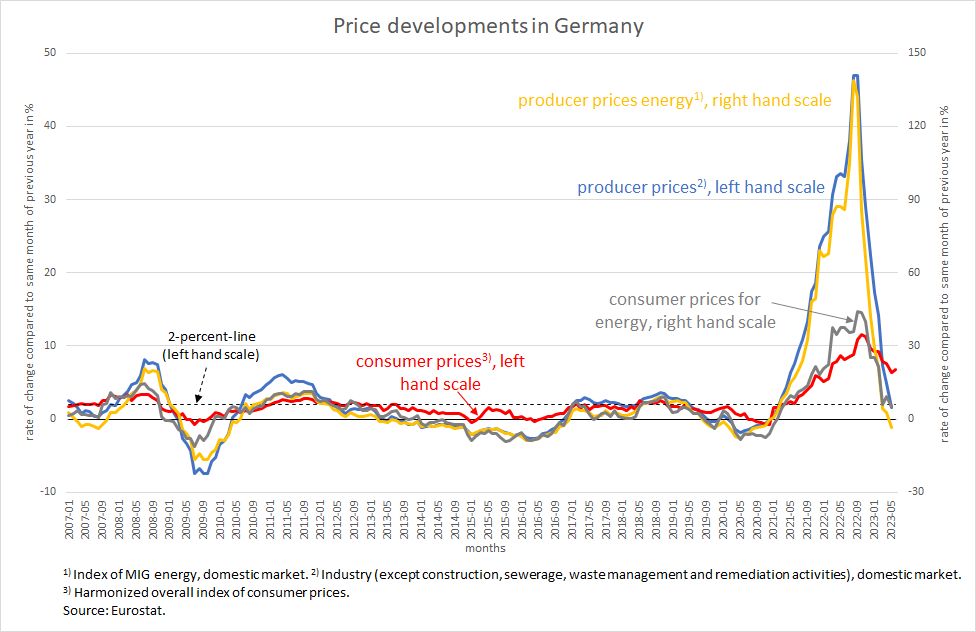

In Germany (Figure 3), the growth rate of producer prices for energy is very slightly negative (compared to the previous year), while that for consumer prices for energy is still positive. The rate for consumer prices as a whole is therefore still well above the 2 per cent mark at 6.8 per cent. However, the core rate (currently 5.1 per cent) seems to have already passed its peak – similar to Spain – in March with 5.9 per cent.

Figure 3

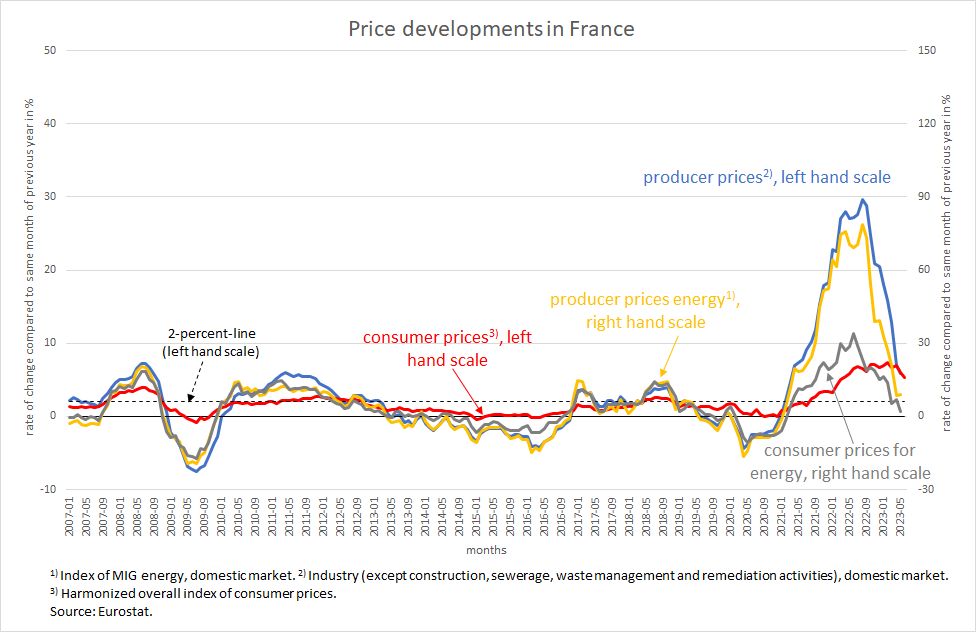

In France (Figure 4), the increase in energy prices and thus in total producer and consumer prices was far lower than in the other countries from the beginning. The counter-reaction is now correspondingly weaker. But here, too, the overall development is likely to follow the pattern that can be seen elsewhere: a lagging of the rate of the overall consumer price index and eventually also of the core rate behind energy prices.

Figure 4

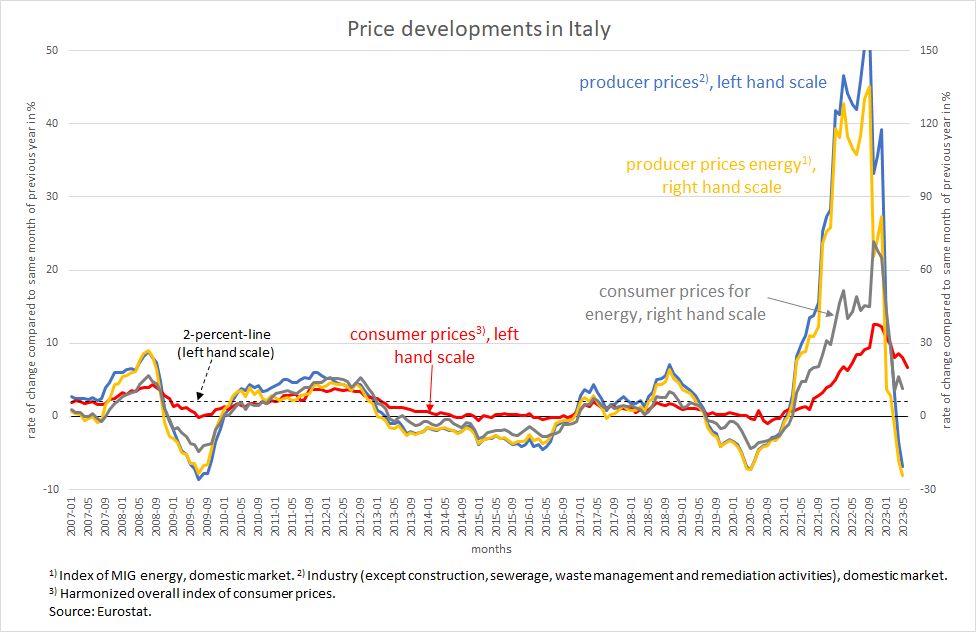

In Italy (Figure 5), although there is a strong reaction in overall producer prices, those for energy at the producer and the consumer level are not yet in negative territory. Whatever the institutional or policy reasons for this, the effect on the overall inflation rate is only a matter of time.

Figure 5

In all five countries, the experience of the global financial crisis clearly suggests that overall producer prices and producer prices for energy are stable leading indicators to the rate of price increases at the consumer level. Consequently, producer prices can be expected to move very far into deflationary territory this time, dragging consumer price developments behind them.

What does this mean for monetary policy?

These trajectories show that the price increases of the last two years and today’s price declines are essentially an energy story. If, in a monetary union, one group of countries has already left inflation behind and another group is still clearly showing rates above the target, it is undeniable that these processes have nothing to do with the common monetary policy that is uniform for all member states.

The naive belief of some observers that “too much” money had been created by the ECB and as a result the debts of the states had risen so much that inflation became inevitable is by now clearly refuted. If there was “too much money” in EMU or if the debt of governments were “too high”, then individual countries would not be able to break away from this demand storm and return to the safe haven of stability. As a reminder, Belgium and Spain, with government debt ratios well over 100 per cent, are after all far above Germany’s approximately 67 per cent.

The ECB urgently needs to correct its view of things and return to a policy of doing everything possible to prevent a deep European recession. The ECB leadership made a grave mistake when it joined the public inflationary hysteria last year. It is probably still secretly convinced of the quantity theory of money. Their website still says: “Ultimately, inflation is a monetary phenomenon”. The chief economist of the Bank of England, Huw Pill, summed up the general confusion of central banks over the theory of inflation, when, according to the FAZ, he recently said at a meeting of central bankers organised by the ECB: “Monetary policy is about medium-term forecasts of macroeconomic developments”. One has to be careful, he adds, not to be misled by Big Data. Instead, it can be helpful to remember “eternal truths” such as the connection between the money supply and nominal (sic!) economic output. To call a definitional relationship such as that money supply times velocity of money circulation equals nominal economic output an “eternal truth” is a declaration of intellectual bankruptcy for any serious scientist.

The ECB is now in danger of undershooting its inflation target with its policy. On the one hand, this means that it will have to deal with negative rates of price increases in the not too distant future. On the other hand, it means that the economic weakness that Europe has been struggling with for more than ten years will be prolonged once again. The ECB bears direct responsibility for this weakness because it has allowed itself to be guided by false ideas. This includes the stern, albeit wrong belief in the long-run neutrality of money. In order to prevent the worst, it must correct itself as soon as possible and lower interest rates to the point where reasonable economic development becomes possible. Even zero rates can then not be taboo.