Anyone in the civilised world who wants to drive a car must prove that he can correctly assess the direction of movement and speed of his vehicle, master the aids of stabilisation and gain a certain overview of the traffic situation. The obligation to pass a driving test meets with general approval among the population, because the person willing to drive a car can put not only himself but also others in danger if he does not have the required skills and knowledge. Those who steer a national economy do not have to prove anything of the sort, although the general danger to the life and welfare of the population posed by their errors of judgement and misconduct is enormous.

Such comparisons come to mind when describing how the German federal government is currently handling the country’s economy. The responsible politicians generally do not seem to understand how dangerous the business cycle dynamics can be once the economy is on a downhill track. This follows directly from the belief in the self-healing powers of the markets, to which at least one coalition partner in German government is attached to. To be precise, the government is currently overlooking the signs that indicate the economy will continue to slide and will not recover on its own. Accordingly, the economic policymakers are unwilling to use the levers available to stabilise the system in time.

Once the economy moves in one direction or the other, the behaviour of private economic actors geared towards individual optimization tends to reinforce that direction – whether it is upwards or downwards. In order to slow down or even reverse a downward movement, one therefore always needs an economic policy that has strong instruments at its disposal to put the brakes on the descent and to reverse the direction. If, for example, the economy is heading towards an abyss for reasons that affect it from the outside (cue Ukraine war and energy crisis), it requires special attention and ultimately also courage to face reality and act accordingly.

Germany and Europe are currently in precisely such a downward spiral triggered from outside. To make matters worse, the one strong policy area that could oppose a downward spiral has already gone in the wrong direction: The ECB is raising interest rates and thus accelerating the downward movement. While monetary policy is likely to prevail, allowing fiscal policy to accelerate the slide is not an option. But according to the draft budget for 2024, the German government is planning a significant reduction in net borrowing, which means giving new impetus to the downward movement. The justification given is the debt brake included in the constitution. But would the constitution really want the German economy to collapse because of an undeterred attempt to comply with the debt brake? And what about political stability if a recession strengthens the political extremes?

Where does the government see a strong private boost?

Anyone who pursues a pro-cyclical economic policy course should have at least some arguments on his side that the private economy will not collapse even under the pressure of this economic policy. But if one studies the official pronouncements, one finds no plausible concept.

In its monthly report of June, the German Bundesbank forecasts a decline in gross domestic product (GDP) of 0.3 percent for this year. Yet its president states:

“[T]he German economy [was] in a so-called “technical” recession at the turn of the year. A technical recession is when the real gross domestic product declines in two consecutive quarters. In this case, high inflation weighed on private consumption in particular. From spring onwards, the German economy should have returned to an – albeit restrained – expansion course. Thus, the strong wage increases should have stabilised consumer spending despite high inflation.” (authors’ translation)

We would like to know where the restrained expansionary course is supposed to come from in the spring, when at the same time all indicators are pointing downwards.

The 2024 draft budget for the current year is based on the German government’s spring projection, in which a slight growth is expected. The Federal Ministry of Finance, which is primarily concerned with complying with the debt brake in the coming year, writes in the introduction to the draft:

“For the remainder of 2023, declining inflation rates, rising wages, an alleviation of supply bottlenecks and a revival of the global economy suggest an economic recovery. However, the latest sentiment indicators underline the existing downside risks. Overall, the Federal Government assumes in its spring projection that real GDP will increase by 0.4% in 2023.” (authors’ translation)

“However, an “economic” recession in the sense of a prolonged, deep slump in economic output with underutilised capacities, falling investment, a decline in employment and rising unemployment is not currently recognizable. … Nevertheless, current economic indicators do not yet point to a noticeable recovery in the second quarter … The expected economic recovery in Germany thus seems to be further delayed. Nevertheless, against the background of declining prices on the global energy markets, a further weakening of inflation dynamics, higher wage settlements and an expected global economic revival, a moderate economic recovery of the German economy is to be expected in the further course of the year.” (authors’ translation)

Rising wages, it seems, are the decisive factor on which the confidence of the government and the Bundesbank is based. Because energy prices are falling and the latest nominal wage settlements are in the upper single digits in the short term partly thanks to one-off payments, real wages, which have fallen sharply so far, are expected to increase significantly and bring about an economic turnaround. This is astonishing, given that previous policy was geared more towards maintaining German competitiveness and supporting profits through wage restraint. Even the government’s minimum wage policy does not give the impression that it has understood how important it is that workers fully participate in general productivity progress.

The current reluctance of private individuals to buy and invest will only be overcome if the government develops a coherent economic policy concept in which it shows that it has understood that macro policy plays a decisive role. So far, the macroeconomic level is left to chance, while all political energy is spent on structural adjustments. With regard to wage increases, one must also take into account that considerable components will disappear again after one year because of one-off payments mentioned above. Whether the remainder – at a higher price level than before the energy crisis – is sufficient to signalise workers that they can look positively into the future is a completely open question. Relying on private consumption to save the economy is extremely risky.

German fiscal policy – like a spaceship alone in space

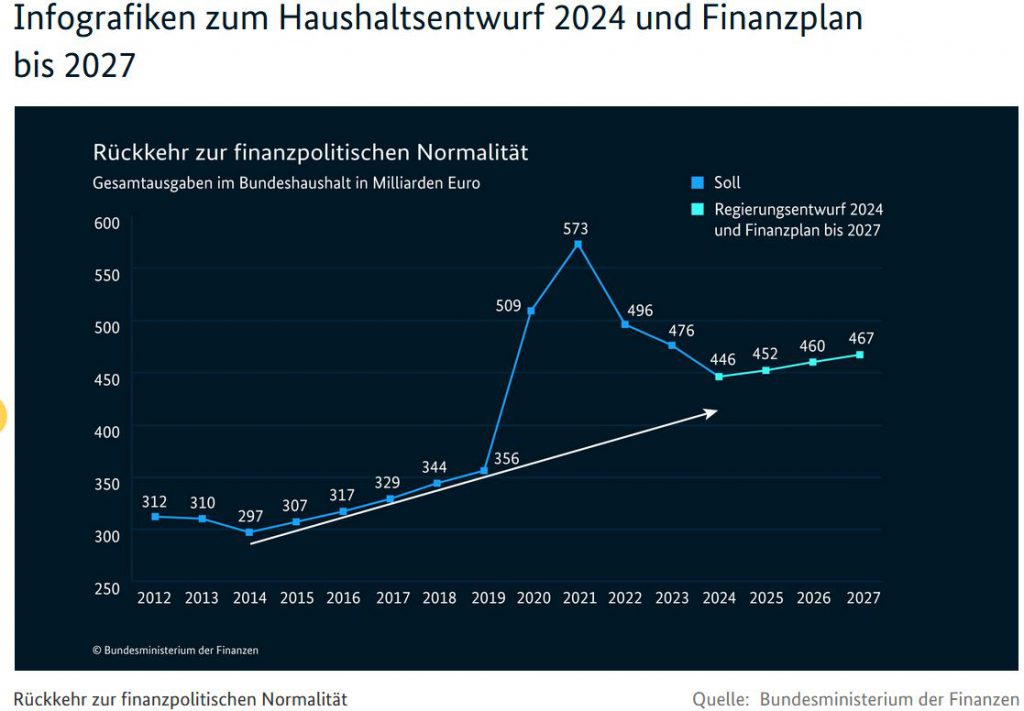

The finance minister shows how to brush aside worries about a crashing economy in his medium-term projection for the federal budget (Figure 1). “The return to fiscal normality” he describes by a straight arrow that, according to his planning, total federal spending will again be roughly on the path taken from 2014. Does it occur to him that the decline in spending from 573 billion euros in 2021 to 476 billion in the current year, combined with restrictive monetary policy, may already have helped trigger or at least intensified the recession of 2023?

Figure 1

The mere fact that such a graph with nominal (!) data in a period of extremely different price developments is placed in a prominent position on the website of the Ministry of Finance shows either how naive those responsible are, or how naive they consider the readers of their site, including the media professionals. The chart illustrates the idea that the state can do what is supposedly constitutional and in line with the economic policy views of those in power, namely to trust in the self-healing powers of the markets or to unleash them by withdrawing the state in as many areas as possible.

No matter how sensible it may be to streamline reporting requirements and approval procedures or even the jungle of tax and duty regulations, they will not override the basic mechanism mentioned at the beginning, which prevails in every market economy: the rational parallel behaviour of private individuals.

How does it really look?

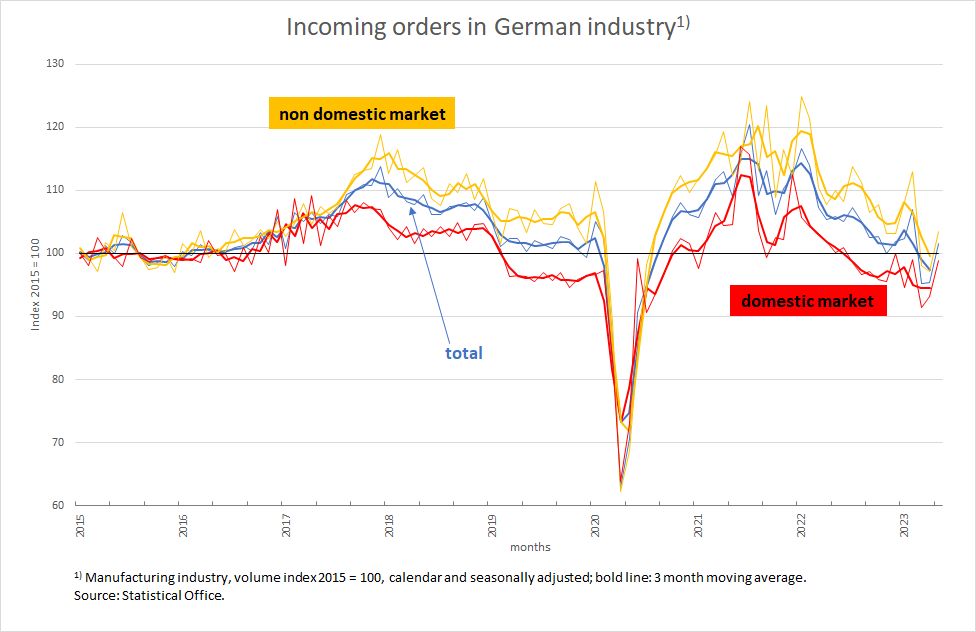

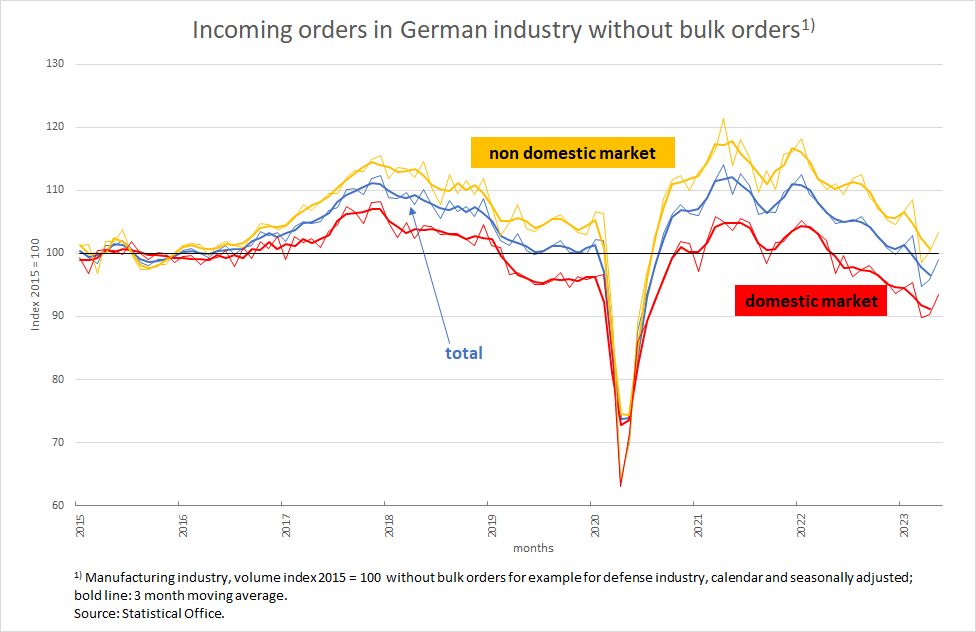

The best indicator of economic activity in the German economy as a whole is still the development in industry. Here the most important leading indicator, incoming orders, has been pointing clearly downwards since the beginning of 2022 (Figures 2 and 3). What is remarkable here is the synchronisation of demand from domestic and non domestic markets. Anyone who, like the Federal Minister of Economics, is counting on the global economy to give the German economy a boost soon should be impressed by these time series. Excluding large orders, which are currently being placed above all in the defence industry, domestic demand in the three-month average is almost ten percentage points below the values of eight years ago.

Figure 2

Figure 3

But the Ministry of Economy is still hoping for an autonomous U-turn of the system when it comments on these figures as follows:

“Overall, new orders, which have fluctuated sharply recently, are stabilising. In a two-month comparison, however, they were still declining (-2.6 %). The order backlog in the manufacturing sector is still at a historically high level despite a progressive reduction, and demand for capital goods increased noticeably in May both at home and abroad. Industrial sales are also pointing upwards again. Against the backdrop of the dampened business climate in the manufacturing sector, this suggests a slight, albeit subdued, expansion in industrial production in the further course.” (authors’ translation)

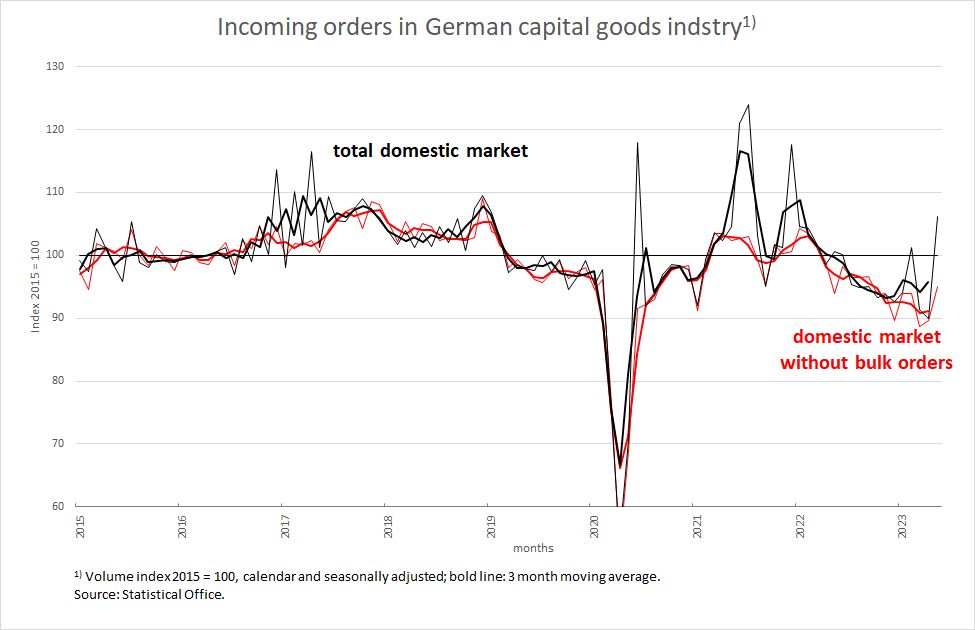

Why the ministry points in particular to domestic capital goods demand to justify its hopes for a turnaround remains its secret. A look at domestic demand for capital goods excluding large (defence) orders (the red line in Figure 4) shows how little domestic investors expect their existing capacity utilisation to increase. Why else would they order around 10 percent less than a year ago or even eight years ago?

Figure 4

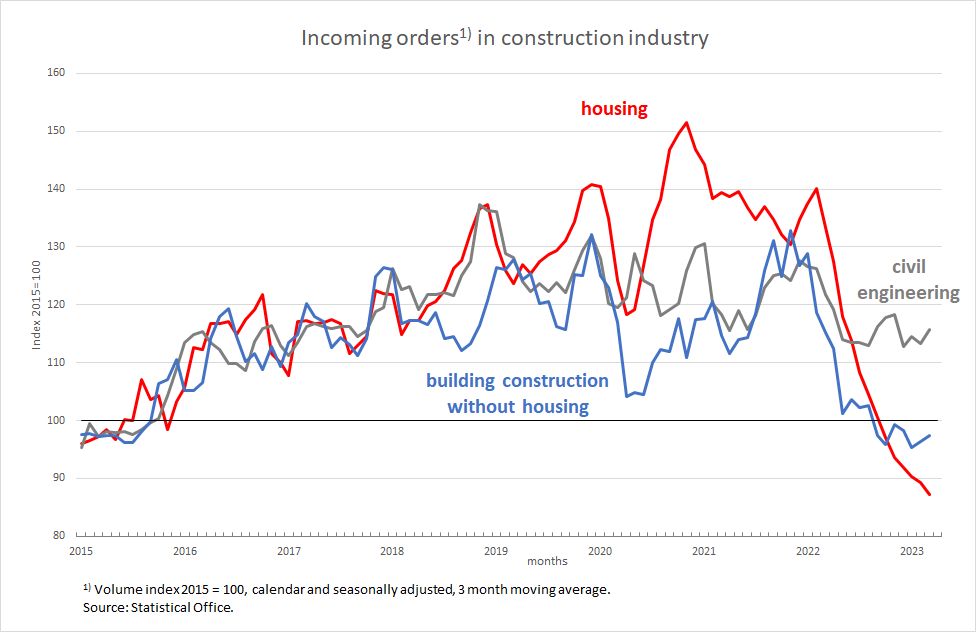

The situation in the German construction industry is even worse than in the manufacturing industry (Figure 5), where housing demand has fundamentally collapsed. This massive decline has not yet been reflected in construction output because companies are currently working off the existing order backlog.

Figure 5

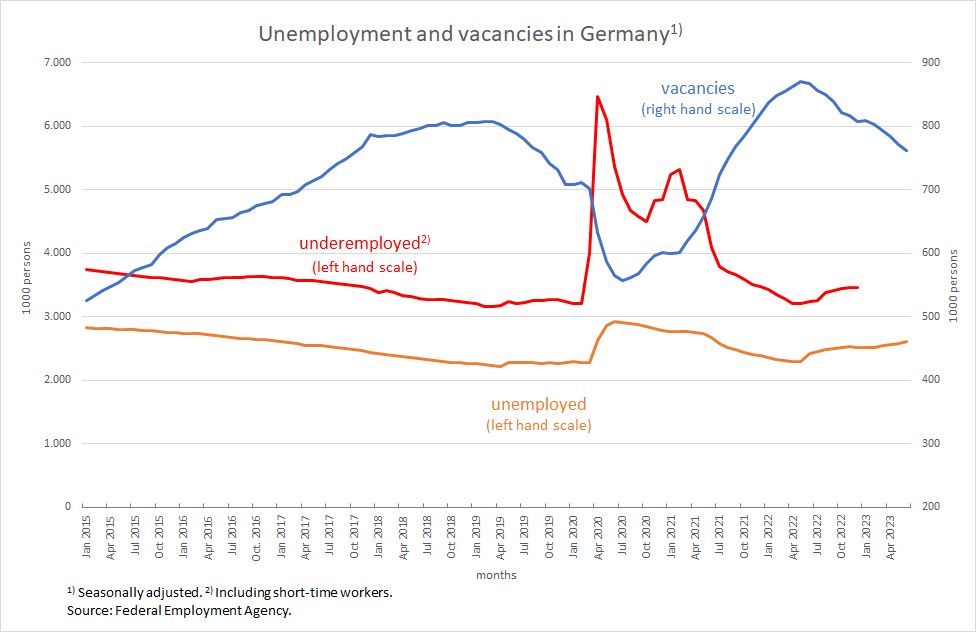

All in all, this has led to unemployment in Germany rising by almost 20,000 people from month to month since the beginning of the year and the number of job vacancies falling by around 9,000 per month (seasonally adjusted, Figure 6). This, too, is a clear indication that many companies do not expect to expand on a normal cyclical path any time soon.

Figure 6

ECB must take labour market into account

It is true that the unemployment rate in Europe has fallen almost continuously since its peak during the euro crisis in 2013 and has recently been lower than in the past four decades. From this, those responsible for economic policy in Europe deduce that we are dealing with “empty” labour markets and labour shortages. This, in turn, makes some optimistic that future wage increases could be high enough to more than compensate for the previous real wage losses due to price surges. Consequently, they see private consumption as a pillar of the economy.

Others, however, especially the central bankers, fear a wage-price spiral, which they use to justify the tight course of monetary policy and declare further interest rate hikes to be the right thing to do. They cite the experience of the two oil price crises of the 1970s, which – in their eyes – showed where an excessive wage policy could lead. The president of the German Bundesbank said with regard to Germany:

“In the short term, for example, wages could rise more than expected. That would prolong the wave of inflation via second-round effects. … A look at history can help to draw the right lessons. The high inflation phase of the 1970s was also accompanied by geopolitical turbulence and energy supply challenges. With today’s knowledge, we can say: de-anchored inflation expectations were an important reason why inflation was so stubbornly high at the time. Important lessons from that time are: Don’t let inflation expectations become de-anchored, don’t react too weakly in terms of monetary policy and don’t ease too soon.” (authors’ translation)

This view is also shared by Isabel Schnabel, the German representative on the ECB’s Executive Board, as can be seen from her interview with Andreas Sator (from minute 23, in German). As already analysed in the article “Wie die EZB den Monetarismus unfreiwillig entlarvt” from 9 June, the concern about strong wage increases is explicitly justified by comparing the labour market situation in Europe then and now.

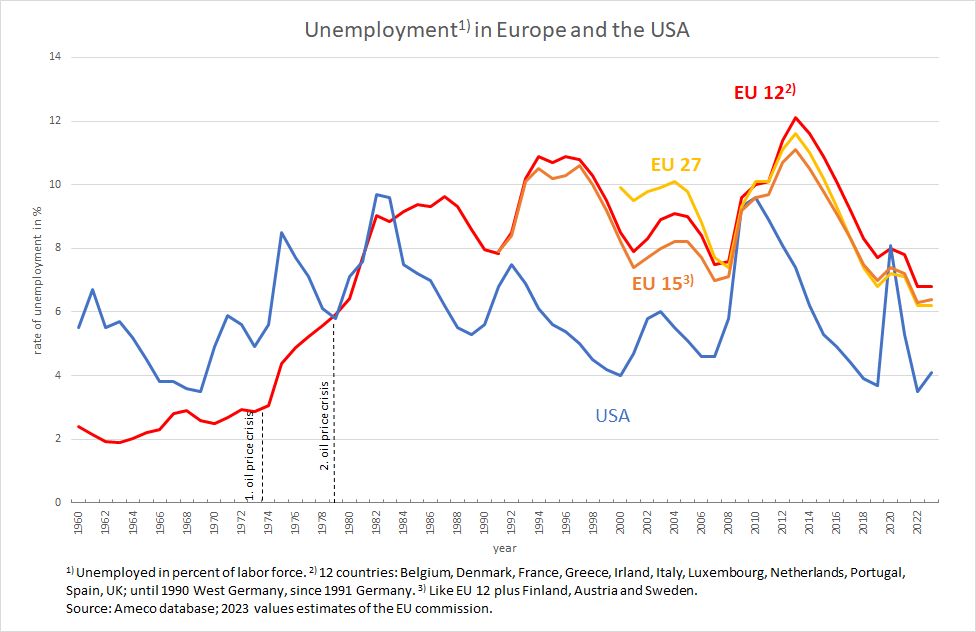

However, a look at unemployment rates in Europe shows that European policy is subject to a misconception about the level of unemployment and the “robustness” of labour markets (Figure 7).

Figure 7

For in the first oil price crisis in the mid-1970s, unemployment in Europe was around 3 per cent, less than half of what it is today. At that time, trade unions managed to force double-digit wage increases. Today, Europe is far from employment figures that can be called full employment. Considering that the definition and coverage of what counts as unemployment has changed several times between the 1960s and today, mostly in favour of a more encouraging unemployment statistics, the difference in rates between then and now becomes even more significant. The trade unions’ assertiveness is much less today than it was then. And thus the comparison which guides the thinking of ECB officials proves the opposite of what it is supposed to deliver: It shows that the current course of European monetary policy cannot be justified by concerns about massively excessive wage settlements.

The situation is different in the USA. There, thanks to massive government programmes after the Corona shock, unemployment rates are now as low as they were in the 1960s, so that the perception that the labour markets have been emptied is justified. And this is what makes the difference between the monetary policy of the FED and the ECB: In the United States there are good reasons for raising interest rates, in the Eurozone there are not.

If estimates concerning the development of wages and employment in Germany are much too optimistic, as is to be feared, sufficient support for the system from private consumption cannot be expected. If, on top of that, European monetary and German fiscal policy hang like millstones around the neck of the German economy, the “economic” recession, which the Federal Ministry of Economics does not want to recognise, is imminent. Economic policymakers should spare us that.