The data on price trends in Europe are more than encouraging. The inflation rate at consumer level in the European Monetary Union (EMU) was only 2.9 percent in October. According to Eurostat, producer prices were down 12.4 percent in September compared to September of last year. This confirms the view expressed in many articles here that the price surge in the eurozone and in many other countries was a temporary event that will recede again with the expected fall in commodity prices at all levels, including consumer prices.

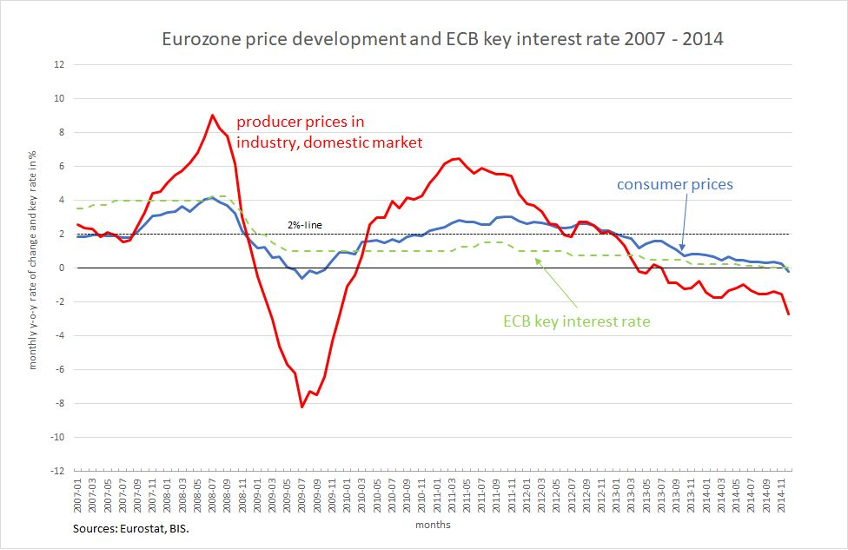

This can easily be seen by comparing the price surge and its normalization from the years of the financial crisis (Figure 1) with the current trend in the most important price indices (Figure 2). Figure 1 shows the price surge in the eurozone before the 2008 financial crisis and the slump afterwards. Consumer prices followed producer prices with a certain time lag and at a slower pace. Obviously, this had nothing to do with interest rate policy at the time.

Figure 1

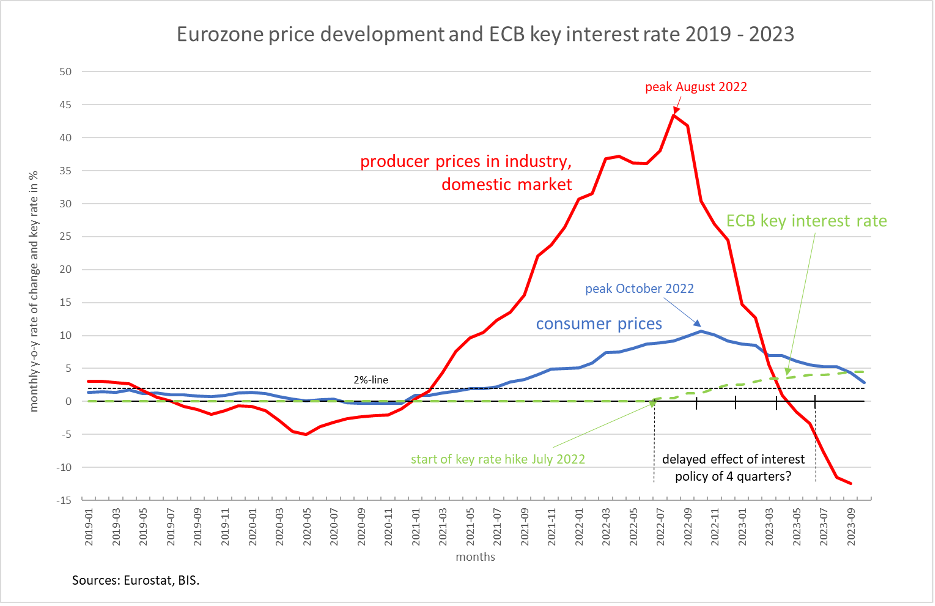

The price surge triggered by the pandemic in 2021 and the war in Ukraine in 2022, which primarily caused producer prices to soar, was considerably stronger (Figure 2), but the processes are very similar to those from 2007 to 2010. Here too, the pattern of easing in price growth rates from summer 2022 had nothing to do with monetary policy. Price increases fell long before the monetary policy restriction, which began in July 2022, started to take effect. Assuming an impact lag of only four quarters (many studies arrive at much longer lags of six to eight quarters), the annual growth rates of producer prices were already below zero when monetary policy could have started to take effect.

Figure 2

Given these clearly visible developments, the reactions of the ECB can only be described as dogmatic. The importance of producer prices as a leading indicator for consumer prices is no longer recognized. The ECB leadership turns to ever new and more abstruse arguments to justify sticking to the restrictive policy of the last one and a half years instead of recognising it as wrong and, above all, correcting it.

ECB Executive Board member Isabel Schnabel, for example, says that the last mile of a marathon is the hardest. That may be true of the marathon. However, applying this image to monetary policy to say that it is more difficult to go from a rate of inflation of 2.9 per cent to 2 per cent than from 10 per cent to, say, 5 per cent, is complete nonsense. ECB President Christine Lagarde is taking the same inappropriate line when, at the press conference on the interest rate decisions at the end of October, she stated to wait for the next round of wage negotiations, “[t]hat is way into 2024”, before changing the course of monetary policy in order to be sure that no new inflationary impulses would come from this side.

The ECB leadership is sticking to its policy and apparently ignoring the empirics of producer prices, despite constantly emphasising that it is pursuing a strictly data-driven approach. The reason is obvious: Most central bankers are guided by the monetarist idea that a considerable inflationary potential has been created over the past ten years due to the loose monetary policy. A greatly expanded money supply must finally be contained by a persistently restrictive interest rate policy. This idea obscures the view of reality and leads to a misjudgement regarding the cause and duration of the phase of high inflation rates.

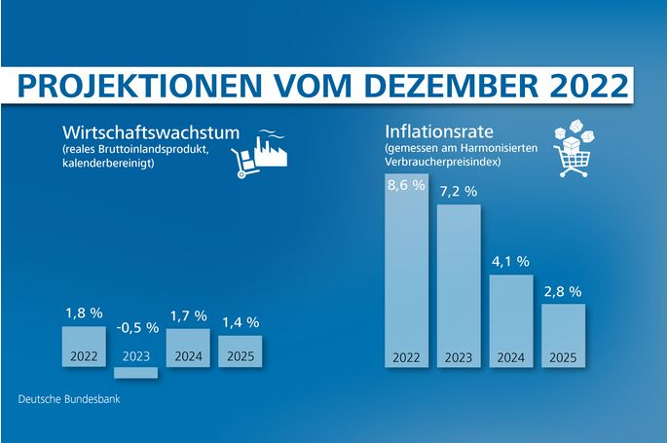

This can be seen in their inflation forecasts. Last December, for example, the German Central Bank forecast that the (harmonized) German inflation rate would average 7.2 percent in 2023 (Figure 3). However, a value of 6 percent is currently realistic. The German Central Bank still expected 4.1 percent for 2024. This is clearly too high if you look at the 3.0 percent that has already been reached at the current margin and, as is usual with forecasts, if you do not assume any unforeseeable shocks in the forecast period.

Figure 3

The German Central Bank only came up with an annual average forecast value of 2.8 per cent for 2025, which was almost realised in October 2023. It looks as though the value expected by the German Central Bank for 2025 will already be reached in 2024.

If we assume that monetary policy will take the usual time to take effect, it is to be feared that we have not yet seen the majority of the restrictive interest rate pressure on economic development in Germany and the eurozone, but that the signs of a slowdown in growth are only just beginning to emerge. The ECB is now having to revise its forecast for economic growth in the eurozone downwards again, as it did in September: According to Eurostat, the third quarter of 2023 with a decline in GDP of -0,1 percent was worse than the ECB had expected. And ECB Vice President Luis de Guindos has just rejected hopes of the slight upward trend forecast for the fourth quarter.

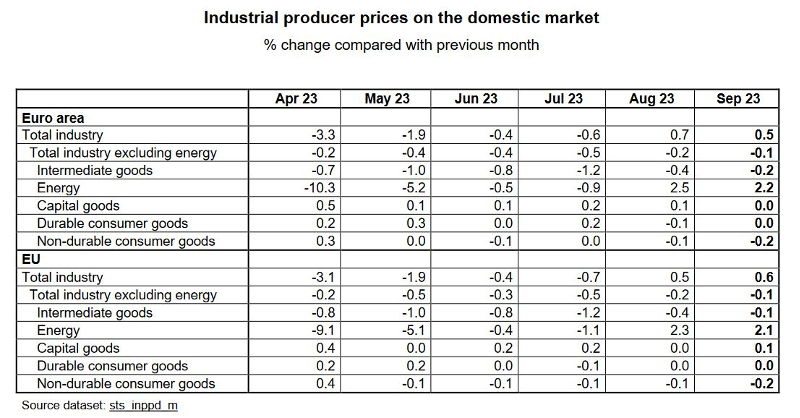

The original Eurostat table below (Table 1) shows that overall producer prices excluding energy (the second line) have been falling for months compared to their previous values. This means that at the preliminary stage of consumer prices (even without the volatile energy sector) there is no inflationary pressure, but even a deflationary development.

Table 1

What is the significance of the last mile that Isabel Schnabel talks about when no inflationary pressure is in the pipeline at the stage of the producer prices? Last March, the ECB itself regarded producer prices as the most important pipeline for consumer prices (as documented here). Now it would rather not talk about this. If, on the other hand, another energy shock were to come from outside, it would be absurd, as we have shown here, to react again with monetary restrictions.

Even more absurd than the last-mile argument is the ECB President’s warning of excessive wage settlements next year. You have to imagine: Despite price increase rates of up to ten percent in individual months, the trade unions have so far been very sensible in their wage settlements and have bridged the very problematic but clearly temporary phase of high price increase rates with one-off payments. Despite considerable one-off payments, labour cost increases have remained below 5 percent even in the second quarter of this year (as can be read here). Now that inflation rates are almost back to normal, the ECB fears that wage increases could jeopardise price stability and therefore wants to postpone interest rate cuts until well into 2024.

Clearly, Christine Lagarde still believes in the fairy tale of the tight European labour market, where workers can now achieve nearly everything they want. Quite apart from the fact that unemployment in Germany is currently rising visibly and the rest of the EMU is also threatened by recession in view of poor surveys, unemployment levels in virtually all countries are far from levels seen in the 1970s, when workers were able to push through extremely high wage increases.

According to the German Federal Employment Agency, the non-harmonised unemployment rate in Germany was 5.8 percent in October on a seasonally adjusted basis, while the underemployment rate was over 7 percent. If the “Stille Reserve” (those people who want to work but do not actively seek a job) of around 3 million persons is included, this amounts to more than 6 million people.

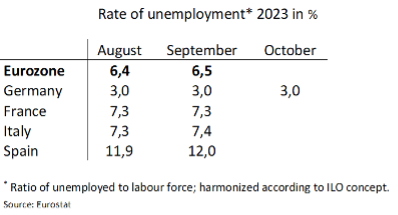

The situation is even worse in the eurozone. With (harmonised) rates of over seven percent (see Table 2), neither France nor Italy can be said to be in a situation where it would be easy for employees to enforce high wage demands, let alone countries such as Spain or Greece.

Table 2

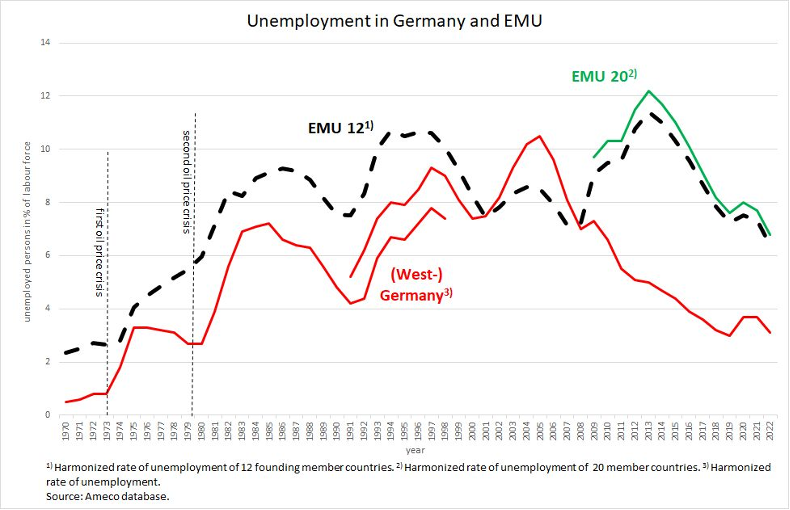

A look far back in time shows that the current unemployment rates in the eurozone (measured in annual averages) can only be described as “historically low”, as for example Isabel Schnabel claims, if history starts where the average calculation for EMU 20 is available from the official statistics (green line in Figure 4), or is based on the founding year of EMU 1999 with the member states at that time. De facto, unemployment in the eurozone in 2022 was as high as at the beginning of the second oil price crisis at the end of the 1970s and thus many times higher than during the boom times at the beginning of the 1970s.

Figure 4

In all major EMU countries, the level of unemployment is now well above what could be described as full employment. It is a real catastrophe for Europe that the ECB cannot be dissuaded from the wrong course it has taken, even though the empirical evidence is now overwhelming, showing that the high rates of price increases in Europe were a temporary phenomenon. Even the much vaunted second-round effects on wages, which could have posed a risk of inflation, have not materialised in the major EMU countries, which essentially determine the average rate of price increases that is relevant for the ECB. It is time for politicians to intervene: they should call on the ECB leadership to address the price stabilisation that has occurred at all levels instead of constantly coming up with new theories that only serve to justify themselves and not the good of Europe.

If energy prices were to rise again due to the current geopolitical conflicts and result in a price surge on a broad front, the ECB would even have to raise interest rates further based on its current understanding of the interdependencies. The ECB would then be even more caught between fuelling a sharp recession in Europe and losing its own credibility.