New data from the German Federal Statistical Office make it clear to even the last doubter: the short phase of high price increases is a thing of the past and the complete normalisation of the trend at the consumer level is only a matter of a few months.

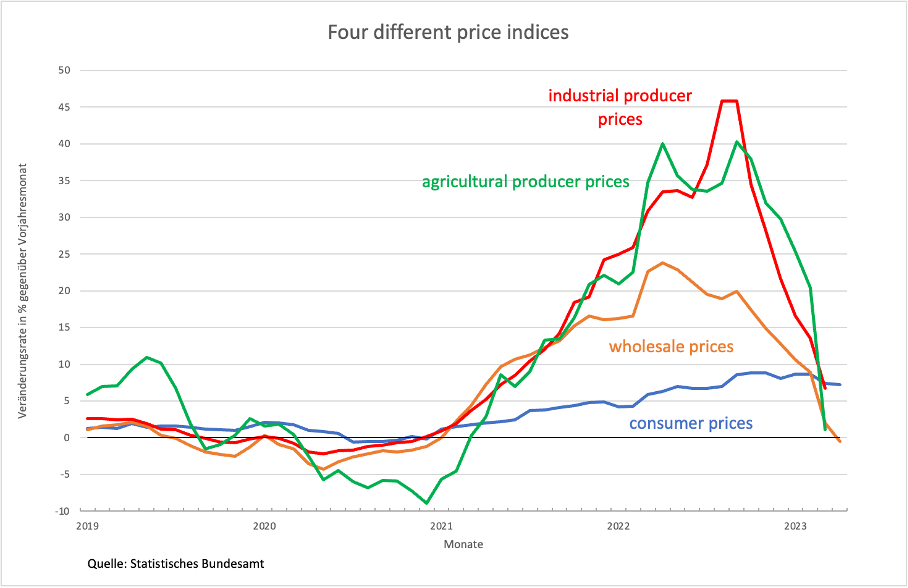

The Office has revised industrial producer prices downwards and published wholesale prices for April. In addition, producer prices for agricultural products for March were published last week. Figure 1 shows the year-on-year growth rates for these three price indices and consumer prices. The result is obvious: the high price increases were a temporary phenomenon, wholesale prices are already falling and the others will follow shortly. There is no new impetus at any level to allow a resurgence of what many have seen as an inflationary process.

Figure 1

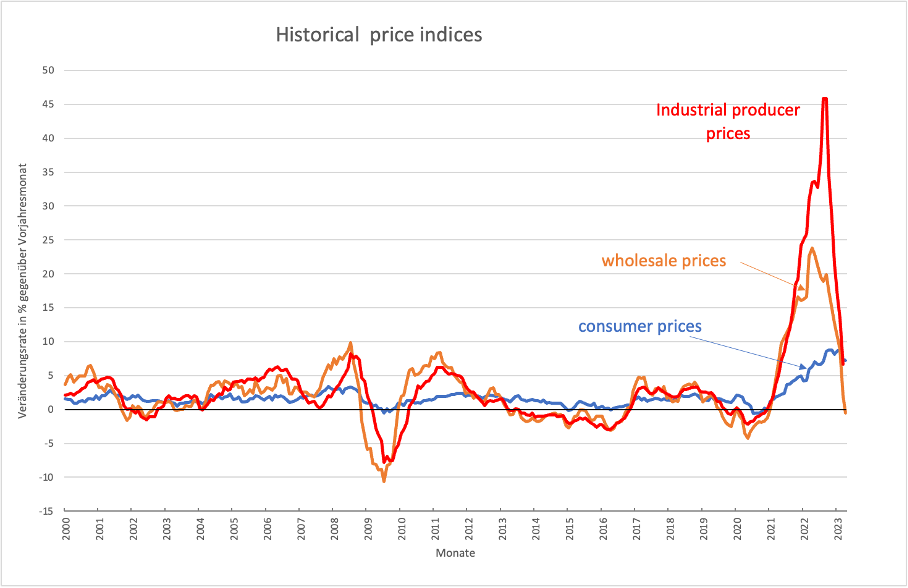

Looking at the path of producer prices and wholesale prices together with consumer prices over a long period (Figure 2), one can clearly see how consumer prices regularly follow the leading producer and wholesale prices in a muted manner.

Figure 2

In particular, the fluctuations in the wake of the global financial crisis of 2008/2009 demonstrate that consumer prices follow the other two indices with a greater or lesser lag. In 2011, for example, producer prices and wholesale prices were already in retreat, but consumer prices continued to rise slightly for a while. The decline in these prices before the Corona crisis also reached the consumer level with a certain delay.

Since such developments, as shown here, can also be observed in the entire EMU, one can only state once again that the ECB’s assertion that there is persistent inflationary pressure lacks any basis (as shown here). If one takes into account that the ECB itself assumes a delay of 18 to 24 months in the effects of its policy, the question of the appropriateness of the current monetary policy and even more so of the announced further interest rate hikes becomes ever more urgent.

If those responsible at the ECB are concerned about wage policy in some smaller EMU member countries, they should talk to the bargaining parties there and help find solutions to the social problems that have arisen from the extreme price surges (keyword: compression of the wage structure). Damaging the EMU as a whole by putting the brakes on investment activity will not help the countries with non-stability-oriented wage policies at all. Their loss of international competitiveness will be all the more negative the more Europe’s economy is weakened by monetary policy. Against this background, the EU Commission’s current forecast reads like the proverbial whistle in the forest.