The downward slide of the German economy continues. Production and incoming orders in German industry are still on course for recession in the first month of the third quarter. The latest sentiment indicators, such as the ifo index and the PMI markit, which were surveyed in August, point clearly downwards. So it can no longer be ruled out that the recession will continue even at a pace much faster than now.

The Federal Minister of Economics considers the situation “challenging”, but he does not do it justice at all when he merely speaks of a current phase of economic weakness and warns against badmouthing Germany as a business location. Both the government and the opposition still believe that they can meet the enormous challenge, which has its origins in the ECB’s misguided interest rate policy (as explained here), with a wild mixture of the most diverse measures (most recently called the “Germany Pact” by the Chancellor). This is the fundamental error.

Further slump in new orders and production

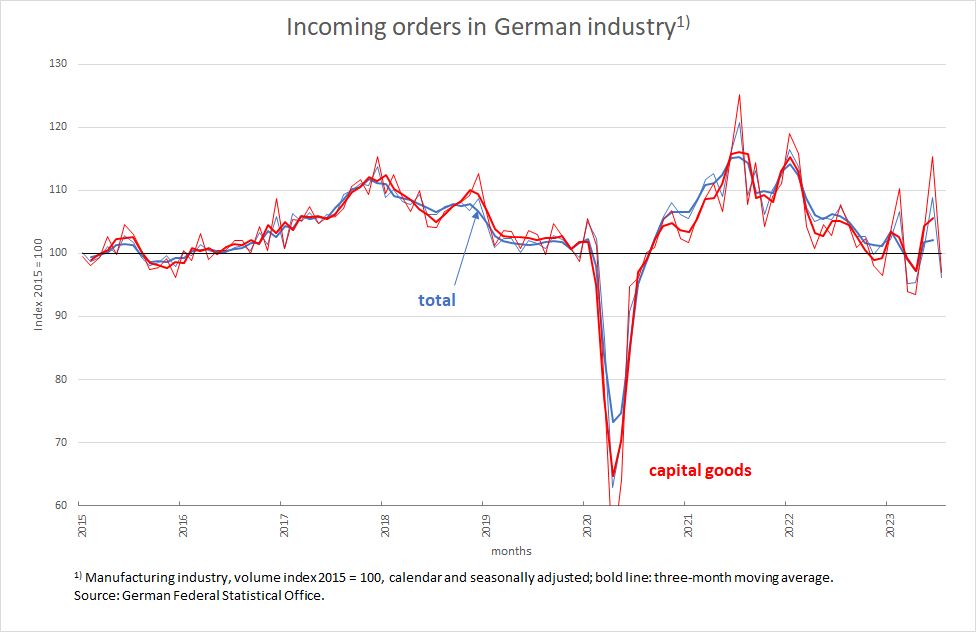

New orders in German industry are characterised by high volatility (Figure 1) because bulk orders, which are likely to be related to public-sector defence contracts, repeatedly overshadow the downward cyclical trend.

Figure 1

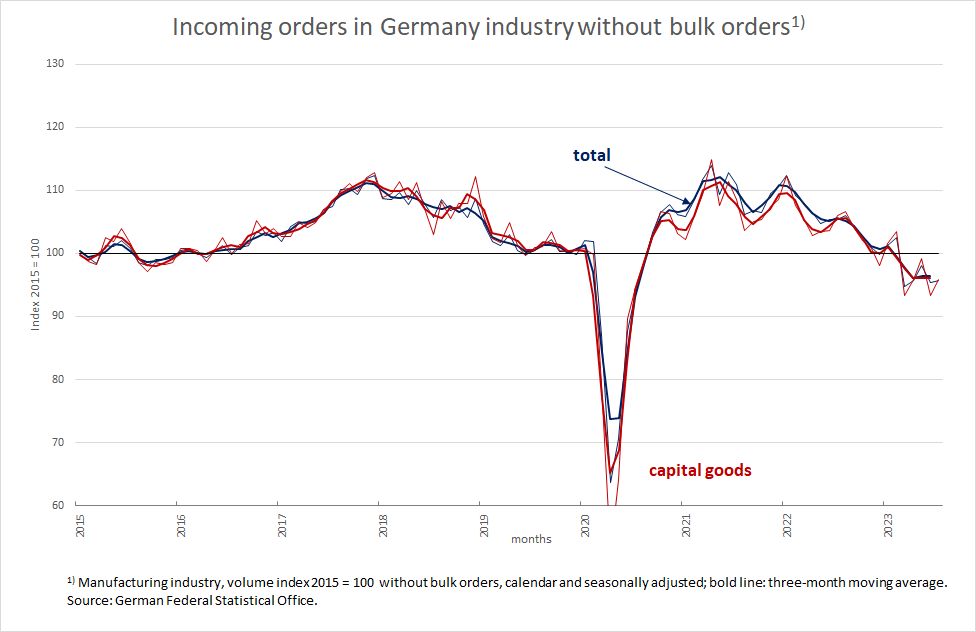

Without the bulk orders, the downward trend, which is particularly characteristic of small and medium-sized enterprises, is more clearly visible (Figure 2): Meanwhile, the level of this indicator is almost 15 percentage points below the peaks reached in 2017 and 2021 respectively. An almost uninterrupted downward trend can be seen since the beginning of 2022. This applies to the indicator as a whole, which depicts the manufacturing sector, but also to the sub-indicator of the capital goods producing industry.

Figure 2

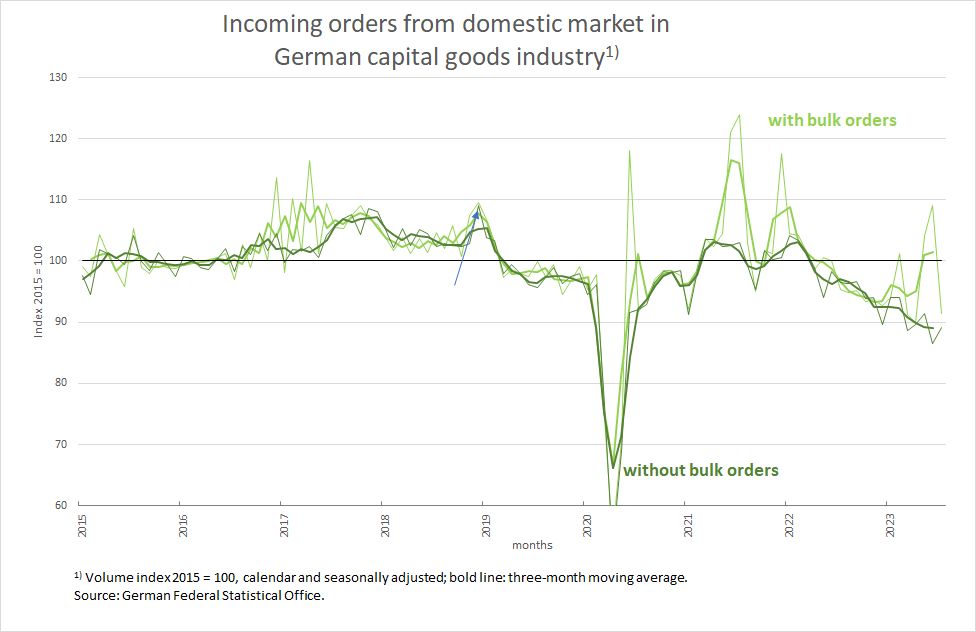

In the case of capital goods orders excluding bulk orders originating in the domestic market – the two darker curves in Figure 3 – the absence of any stabilising trend is obvious. Considering that this index has its base of 100 in 2015, an index level of currently less than 90 shows how badly off investment activity is in Germany – and this despite all the institutional course-setting and support programmes announced or implemented at national and EU level that are supposed to bring about the ecological transformation of the economy.

Figure 3

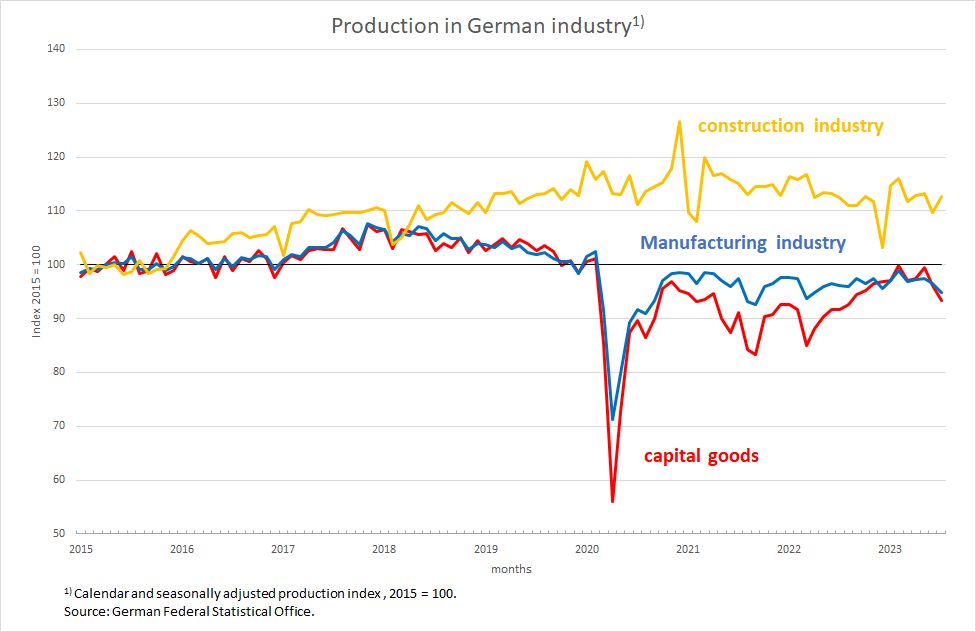

The decline in demand is also gradually making itself felt in production: The stagnating order backlogs in industry as well as in construction are visibly being worked off and, due to the lack of corresponding follow-up orders, production is gradually declining. The capital goods sector is also visibly affected. Since this indicator is not differentiated according to large orders and sales direction, the development, which is meaningful for the domestic outlook for structural change and productivity growth, is likely to be even bleaker de facto.

Figure 4

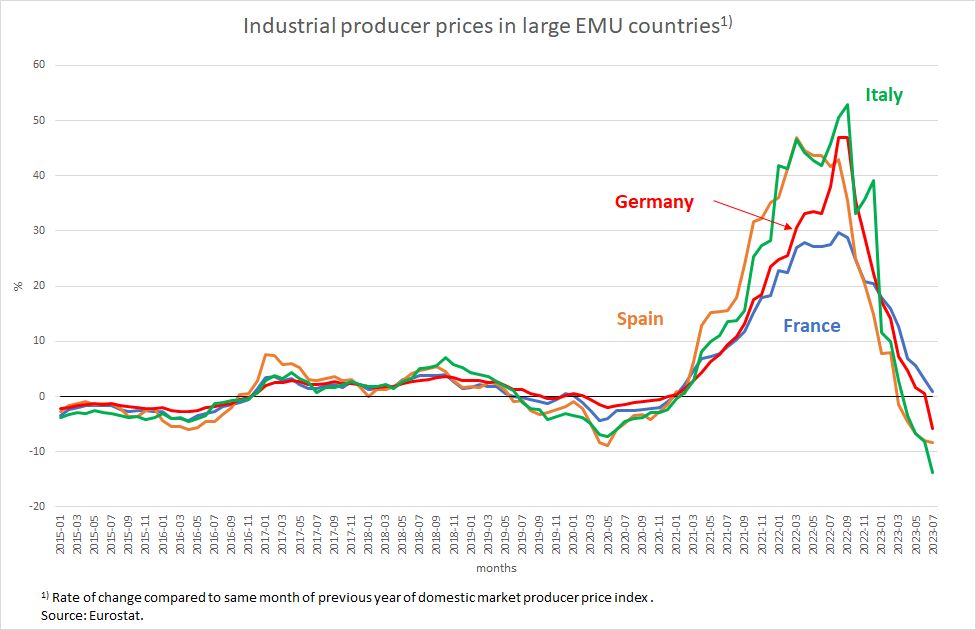

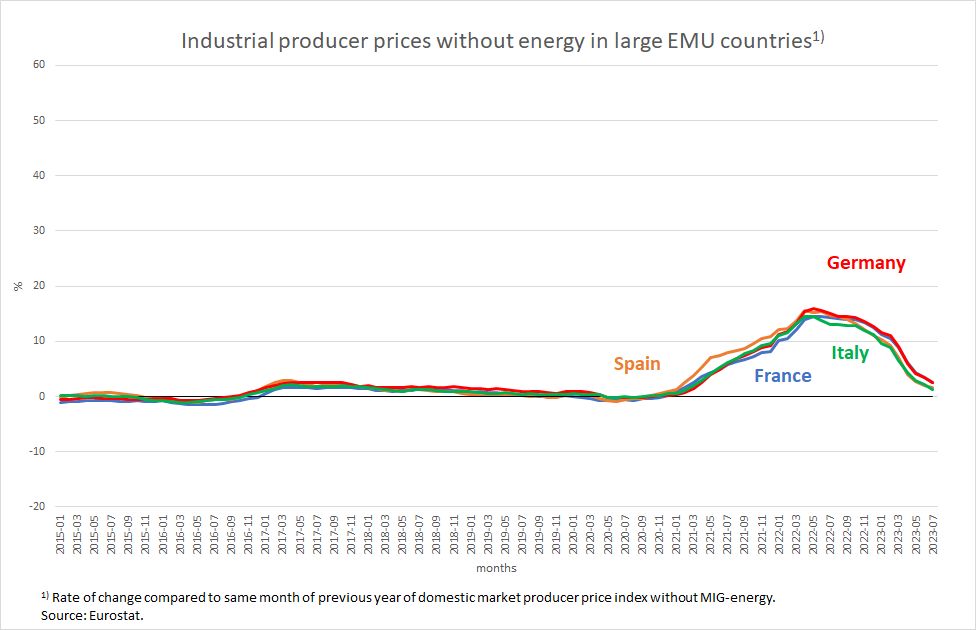

This development must be seen against the background that industrial companies in Germany and in the entire EMU are facing almost stagnating and in some cases falling prices and, in parallel, comparatively high interest rates. The differences in the development of producer prices between the four large EMU countries are mainly due to the energy sector, as can be seen from a comparison of Figures 5 and 6: Excluding energy, the growth rates of producer prices in Germany, France, Italy and Spain are almost parallel (Figure 6). The overall indices (Figure 5) thus differ largely only because of the development of producer prices in the energy sector. Incidentally, in this comparison of countries, Germany by no means shows the steepest price increase in the course of the energy price crisis.

Figure 5

Figure 6

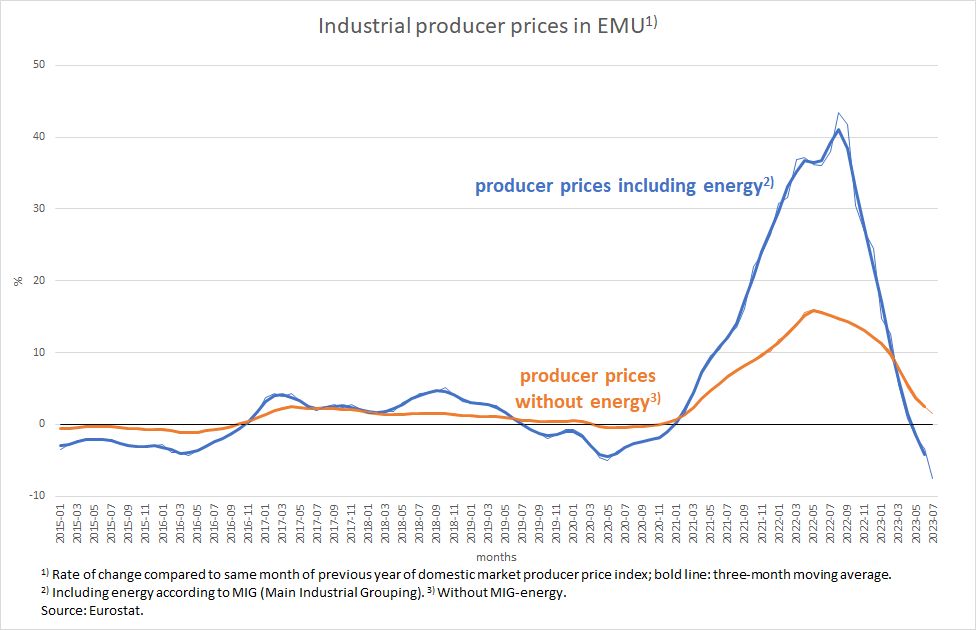

The previous year’s rate of producer prices in the EMU as a whole (Figure 7), excluding the energy sector, is now less than two percent, while the rate including the energy sector has now reached -7.6 percent.

Figure 7

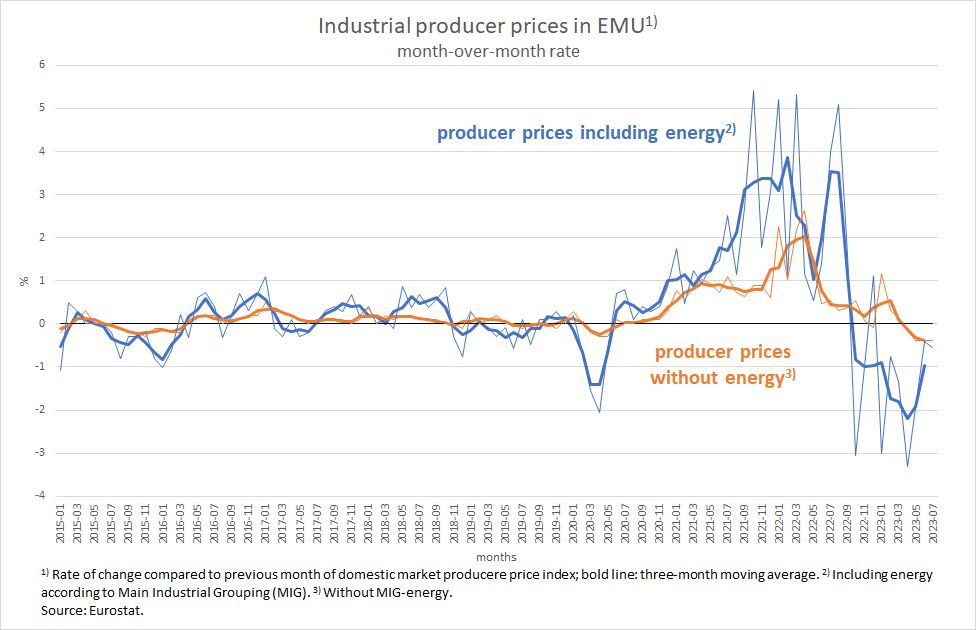

The development that is actually relevant for businesses, however, is that of the price changes from month to month (Figure 8). Here, the rates without energy are also negative, those including energy are deep in the red. Actually, those responsible at the ECB always emphasise that they are interested in people’s inflation expectations, as they consider them important for their future behaviour. At this point, however, the central bankers seem to rather close their eyes, otherwise they would have to realise that the price expectations of companies are currently likely to be negative. If that is the case, interest rates are obviously far too high to allow even a hint of positive investment sentiment without massive public subsidies.

Figure 8

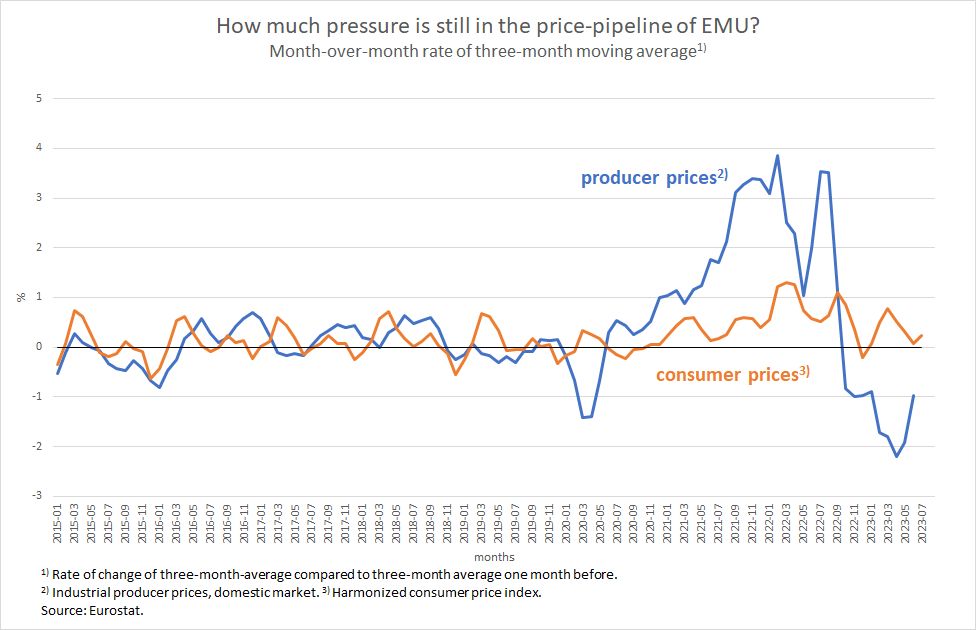

If the driving forces in the ECB do not quickly realise that their view of things is completely inappropriate, a very long crisis cannot be ruled out. Figure 9 shows once again that with a forward-looking analysis based on month-to-month developments, there is no longer any question of an inflationary threat in the EMU.

Figure 9

Why forecasts for 2024 should be treated with great caution

Unfortunately, it is common practice for most professional forecasters to turn the figures back in a positive direction at the end of the time horizon of their forecast when things looked gloomy beforehand – they show the light at the end of the tunnel, so to speak. The FAZ uses this to make the statement that at the end of the year and next year “the trend” then points slightly upwards again. This may be true for the trend of the forecasts, but is it also a meaningful statement for the economic development itself? According to the dictionary, “trend” means the “recognisable direction of a development” or a “strong tendency”. However, the current trend is clearly pointing downwards. So a turnaround is needed before there is an upward trend in the economy again.

And such a trend reversal needs impulses because the market economy system cannot stabilise on its own thanks to the parallel behaviour of the individual private economic actors. This is precisely what the development since the fourth quarter of 2022, referred to by many experts as the “mild winter recession”, has shown: there was no automatism that would have brought the economy back onto a growth path. Waiting in the hope that everything will be fine again by itself according to the motto “What goes down will eventually go up again” or “Up and down is the nature of the economy” is the wrong economic policy strategy, based on a false idea of macroeconomic processes and the dynamics that follow from them.

The latest forecasts of various institutes (IfW in Kiel, IWH in Halle and ifo in Munich) are all characterised by the fact that they believe that German exports will pick up quickly and that the current account surplus will rise from 4.2 percent in 2022 to over 6 percent in the current year and even to over 7 percent in 2024 (IfW and ifo). All three institutes predict that private investment activity in equipment will not be dampened in the current year – despite the constellation of high interest rates and declining economic development. The latter, as the above indicators for the capital goods sector in Germany show, is pure expedient optimism. And it remains to be seen whether other countries, especially in Europe, which is subject to the same interest rate policy as Germany, will be able to generate such strong demand that German exporters will be able to profit from it to the extent forecast.

As long as the basic constellation of high interest rates and a deflationary price trend at the level of domestic producers remains, no recovery is in sight. Insightful politicians would do well to coordinate with their European colleagues and to take the ECB to task in the Eurogroup.